Your Budget is Meaningless

By Stephanie Sims December 20, 2013

Unless you understand where the numbers come from.

I’m betting this means that many of you either don’t have a budget, or have a budget created by someone else that you only look at when you absolutely have to – meaning when some finance person (accountant, banker, etc.) tells you to. Since we are approaching the beginning of the year, there’s probably someone telling you that “it’s that time again!”

It’s no secret that many business owners (small and large) dislike finance and finance people. They’ve got no sense of humor, they dress funny, and they speak a different language. Even when they work for you – raise your hand if I just described your accountant.

And it’s true that some finance people don’t have a clue about how finance relates to your business – they just follow the rules/formula/one-size-fits-all approach and it either works or it doesn’t.

So you might be tempted to just leave the budgeting to the finance people and wash your hands of the whole thing. After all, who needs a budget and regular reporting anyway? Banks, maybe. Eventually investors, but once you get that big, you won’t have to worry about it at all, right?

WRONG.

Creating and reviewing your budget regularly are one of the most beneficial things you can do for your business. And you, the owner, are the ONLY one to do it – although it’s perfectly okay to include others (like sales and production managers, and your internal finance staff once you have them) in the fun.

Why? Because in order to really understand what’s happening in your company and how you can create value (for yourself, your employees, and any investors you might eventually take on), you have to fully comprehend where the money comes from – aka sales – and how much it costs to get in the door – aka expenses.

Creating your budget requires you to understand how your product gets made, how it gets sent to customers, and how/when/where/why those customers buy it. It helps you rate the importance of any one element, like a particular customer or a supplier. And, it helps you understand the most likely place that things can go wrong (hint – it’s usually where you have trouble getting a good estimate of cost, or units sold, or something similar). And reviewing your budget regularly shows you whether things are working the way you expected them to.

Not surprisingly, all of this is very important knowledge for an owner – whether it’s related to finance or not. In fact, I think that the least important result of any budgeting process is the budget itself. That’s why your budget is meaningless – if it’s just numbers.

For example, if you budget $1,000 in sales in January, but you’re not sure exactly how those sales will come about, what actions can you take if you only sell $900? If your sales budget is based on having 5 clients that each buy $200 worth of product ($1,000), and you only have 4 clients who purchased $225 each ($900), you have learned something important about your customers – each one spends more than you thought. So missing the budget is actually a good thing, because it helps you understand your clients, and perhaps take advantage of an opportunity in the market.

Now wouldn’t you have felt silly if you’d chewed out your sales reps for missing their target?

Likewise, if you expected to sell $1,000 to 5 clients, but instead you sold $1,100 to a single client, is this cause for rejoicing or bad news? It’s a great month, but it is a risky way to run your business. You’d better be looking for additional clients, pronto, otherwise if/when this one disappears, so does ALL your business. Be kind of silly to buy that sales rep a beer and tell him to quit looking for new clients, right?

Ultimately, a budget without a process behind it is just a set of numbers. The value of your budget comes from the education you get each time you create it and the feedback you get each time you review it.

Big companies pay big money to set up intricate management systems with all sorts of bells and whistles that tell them how they’re performing (these are often called KPIs or Key Performance Indicators). You can do the same without all the expense – all you need is to make your budget work for you!

Do you use a budget? Does it work for you? Tell me why or why not in the comments!

Tags: It's All In Your Head - Number Whispering - Signposts And Directions - Walk The Walk

Is Finance Really a Four-Letter Word?

By Stephanie Sims January 16, 2014 Blog, The "F" Word

Finance has its share of villains, both in fiction and in real life, who’ve created a distaste for finance that isn’t serving entrepreneurs well.

Because unless you’re independently wealthy (in which case, you’re probably not starting a business to make money), you’ll have to work with some finance types to get your business off the ground and keep it growing.

But (Gordon Gekko aside) finance types aren’t the culprits – in fact, once you understand financial principles, you can make them work for you without feeling slimy or selling your soul. But (and this is crucial in all aspects of your business), you need to take control of your own destiny.

First, you need to understand one of the fundamental principals of finance: the riskier something is, the more you’ll have to pay to get someone to invest in it.

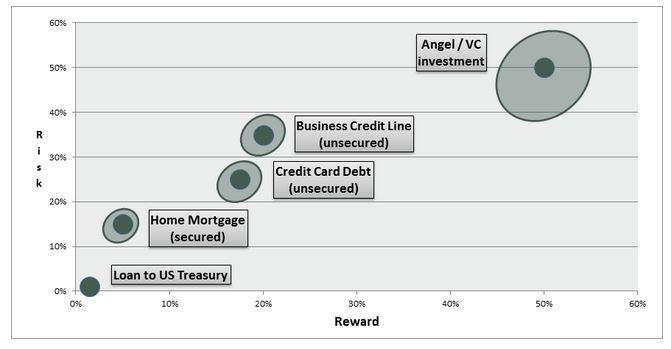

This is referred to as the risk/reward tradeoff*, and it looks something like this:

In this illustration, the dark points indicate the general range for risk/reward, and show that depending upon WHO is borrowing (and how the person lending feels about them), the reward required for someone to make that investment increases. As an example, if I want to obtain a business credit line, I know that the bank will expect a potential loss of 35%, and will want a reward (in this case, an interest rate) of about 20%.

The ovals around the dark points show how perception can influence these risk/reward tradeoffs. Within each investment type, individuals and their perception of the risk will influence the rewards they will require to invest. So, continuing my example, if I’m able to develop a great relationship with my banker, and I have a well-thought out response to most of her questions, I should be able to reduce her perception of the risk of MY business, and reduce the reward (interest rate) that she’ll require.

With me so far?

Second, you need to understand that this is not rocket science – you already use this principle every day.

When someone wants to borrow money from you, for example. If you don’t know the person at all, you perceive the risk to be high; so high in fact, that you probably wouldn’t even make the loan. However, if it’s someone you know reasonably well, you’ll review several factors (such as how much they are asking for, whether they can pay you back, how much you think they need the loan, and whether you trust them and communicate openly with them) before you make a decision.

Sound like common sense? Then you’ve already got good insight into a bank/investor’s thought process when you approach them for an investment.

Since your relationship with the bank/investor may be on the newer or more superficial side, you’ll have a lot of work ahead to convince them to provide you with funding. It means that you need to clearly understand where the risks are in your business, and then work on decreasing their impact on your business.

It also means that you need to develop a relationship with your banker/potential investor, so that they get to know you and have a better idea of how trustworthy you are. Being able to answer the following questions will go a long way to building trust:

- What is your business is capable of becoming and what it will take to get you there, in terms of time, money and personnel?

- What will you be using the requested funds to do? If your answer is “pay my (or other founders’) salary”, you’re dead in the water. Would you loan someone money to pay themselves a salary?

- What are the scenarios under which the funds can’t be returned? How likely are they, and how soon can more information about those probabilities be obtained?

When you talk about those risks and how you’ll address them, you’ll build credibility. Once you’ve established a genuine relationship and trust, banks and investors will be much more likely to want to work with you.

If you don’t have enough money to finance your company – which, let’s face it, is where most of us find ourselves – you’ll be looking to banks and/or investors to provide capital (cash, dough, greenbacks, you get the idea). To make the most of what the finance types can do for you, you’ll need to put yourself in their shoes and try to identify any other risks that they may perceive (perception is NOT reality, but in this game, it’s the perception that counts until you build a stronger relationship).

Your assignment: identify three risks in your business that you could improve on, and tell me about them in the comments. Let’s see which ones we have in common!

Tags: Investors' BrainsRisk/Reward

Want to Build Your Credibility with Investors? Just Do and Say.

By Stephanie Sims January 24, 2014 Blog, Where's the money?

In a previous post (Is Finance Really a 4 Letter Word), I mentioned that credibility and building relationships are often the “it” factor in getting funded, since they both can reduce the perceptions of risk associated with your business. This is particularly true when dealing with banks and investors, who see plenty of requests each day, and need some way to choose among them.

You already understand intuitively why trust plays a role – you’re more likely to invest money with someone that you feel you can trust than with someone you’ve just met.

There are lots of articles about how to approach investors (find out their hobbies and claiming it as one of yours is a popular one lately), how to write the “perfect” business plan, and even what to wear when you meet them. While your business plan and how you present yourself have a role to play, I believe that following one simple rule will have a much bigger impact on building your credibility:

Do what you say, and say what you do.

It is definitely simple, but far from easy. Because it means that your word is your bond, that by agreeing to something, you are committing to follow through. And in a world where excuses abound and many public figures have made careers out of shading or even hiding the truth, this is a very difficult thing to do.

Why?

Well, for starters, there is the “before” and “after” aspect of this maxim. In order to be able to take the credit afterwards, you had to know (and say) what you were going to do beforehand. Which requires plenty of planning, forethought, and the ability to describe those plans and vision to someone else in a coherent way. And that doesn’t happen overnight, so there is also lots of hard work involved.

Don’t promise what you can’t deliver, and you’ll make your life a lot easier when it’s time to say what you did.

Secondly, you have to use this maxim in every situation, not just when it’s convenient. Delivering a project on time and on budget makes everyone happy, so it’s easy to talk about that. But what about when you’ve missed a deadline, and don’t know how you’ll make it up. Or when you’ve unintentionally divulged confidential information. Or when you’ve decided not to pay a supplier because you’re out of cash. Or any of the other things that can (and do) go wrong when you’re running your own business.

When things go wrong, make it right. Do what you said you would.

But wait, you say – we’re talking about business here. Isn’t there supposed to be a certain amount of embellishment, to put things in a positive light? If I talk about my mistakes, won’t the other guy get the investment (or the client or whatever I’m competing for)? I can’t be all Pollyannaish when everyone else is spinning the truth like Run DMC!

It’s certainly possible that someone else with a better “story” will win today, but if your goal is to build a business that has real value, you not only have to develop excellent products and services, you have to develop a reputation for excellence – personally AND for your company. And using this approach will be a huge step towards developing that reputation.

Besides helping you obtain funding and maintain a great relationship with your investors, following this rule has other benefits for you and your company, including:

Better communication with clients = more opportunities for new business

Open, honest communication with clients will not only build credibility, it will make it easier for your clients to tell you about other problems that they are having, which in turn allows you to develop more solutions to those problems.

Better communication with employees = less turnover and more committed employees

Keeping your word with your employees creates a genuine relationship, so it’s easier to talk about what went right AND what went wrong. And when you give honest feedback, you also get honest feedback, which means that employees are more likely to tell you what they really want – it may be something besides a new office or free coffee in the break room!

Better communication in general = an “it” factor that makes you unique

Given the rarity of this attitude in today’s world, this simple factor can give you a very important competitive advantage – you’ll be one of the only companies doing it! And, as a method for getting business, or attracting the right employees, or developing a mutually beneficial relationship with your suppliers, this “it” factor is another way to stand out from the competition.

Do you already live by this (or a similar) maxim? Tell me why (or why not) this could be a game-changer for you in the comments – I’d love to hear your thoughts!

Tags: Investors' Brains - Talk The Talk - Walk The Walk

Owning a Business is Like an Exotic Vacation – Part 1

By Stephanie Sims January 31, 2014 Blog, Building Value

This week, I’ve done some things that I never imagined I would have. I’ve been involved in some live videos (called HOAs) on Google +, and I’ve been challenged to think about what I’m really trying to build in my business and why. And while I don’t have the answers to all these questions yet, I’m feeling pretty good about how this week has gone.

But the awesome things that I’ve experienced this week wouldn’t have been possible if I had followed my initial plan, if I had been so focused on the way I thought I should do things that I missed the forest for the trees.

Current wisdom seems to be that building a business has to be painful, difficult, all struggle until you finally reach that “pot of gold” at the end of your rainbow. That if you do everything “right”, success will follow.

But more and more, I see building my business as a process that can be challenging but enjoyable, exhausting but exhilarating at the same time…kind of like an exotic vacation!

Business ownership like a vacation? How is that possible?

Imagine that you’re planning to visit somewhere that you’ve always dreamed of going…to get there, you need to remember:

- Every vacation requires research, planning and budgeting – you can’t wait until you get there to reserve hotels, get train tickets, and ensure that you’ve got enough local currency.

- You won’t have time to do everything, so you’ll need to choose your opportunities wisely – is it better to stand in line for 5 hours waiting to see the Mona Lisa, or could you see the entire Louvre in that time?

- The locals won’t necessarily speak your language, so you’ll have to find a way to communicate with them in order to survive.

- Fellow travelers can be both a blessing and a curse – it’s nice to see someone “like you”, but generally they’re all going to the same place!

- You have to keep a close eye on everything (bus schedules, your bags, your $$, locals and other tourists) once you get started.

- There’s a tendency to have high expectations at the beginning, but constant change can be wearying – you’ll have to remind yourself what your initial vision was from time to time.

- Ultimately, it’s up to you to make the most of it – you get out what you put in!

- My ideal vacation is nothing like your ideal vacation…The only way to really enjoy a vacation is to make sure that it fits the person traveling, regardless of where other people are going (or have been).

- Lastly, if you stay open to new experiences, you meet some of the nicest people along the way, and discover that the detours could be the best part of the trip.

Not clear about to how these things apply to your business? We’ll revisit that next week!

A huge thank you to Chris, Meagan and Tracy (and Roy, too!) – I really appreciate you all making this week a period of amazing growth for me ;-)

Tags: It's All In Your Head - Signposts And Directions

Owning a Business is Like an Exotic Vacation – Part 2

By Stephanie Sims February 14, 2014 Blog, Building Value

Recently, I talked about getting some perspective and looking at building your business in a very different light.

I mentioned that it’s crucial to realize that things won’t always go to plan, and that this is part of what makes owning your business exciting (and scary at times). I even compared building a business to an exotic vacation. Sounds pretty far-fetched, right?

There are more similarities than you might think, and I believe that with the right mindset, either endeavor can be rewarding and bring you joy. You just need to get yourself in a frame of mind that allows you to see what the situation is trying to teach you.

Using the examples from my last post, let’s compare the two (vacation and business):

- Every vacation requires research, planning and budgeting – you can’t wait until you get there to reserve hotels, get train tickets, and ensure that you’ve got enough local currency. In business, you also have to choose a destination, decide which path you want to pursue to get to it, and understand how much it will cost. These processes are ongoing, so don’t think that once you’ve “arrived” at your destination, the journey is over!

- You won’t have time to do everything, so you’ll need to choose your opportunities wisely – is it better to stand in line for 5 hours waiting to see the Mona Lisa, or could you see the entire Louvre in that time? In business, you’ll always have more things to accomplish than time to do so. It’s crucial to establish priorities based on what will help your business the most – even when you might really want to do something else.

- The locals won’t necessarily speak your language, so you’ll have to find a way to communicate with them in order to survive. In business, you’ll have to change the way you think about “them” and “us” – no business can survive without relationships, and to build relationships, you have to find common ground. This will require you to step outside of your comfort zone (often!), to learn new things, and to try someone else’s perspective instead of your own. But when you’re able to create a connection (with clients, vendors, employees, and others), the benefit to your business will be amazing!

- Fellow travelers can be both a blessing and a curse – it’s nice to see someone “like you”, but generally they’re all going to the same place! In business, it’s nice to be part of a known market (it usually means that there are lots of buyers), but it’s difficult to stand out in the crowd. Work hard to identify what YOUR business provides that is uniquely valuable to your clients, and then ensure that you maintain the highest quality on that. Even better, strike out on your own, and see if your unique value proposition can’t create its own market!

- You have to keep a close eye on everything (bus schedules, your bags, your $$, locals and other tourists) once you get started. In business, establishing expectations (also called targets, metrics, KPIs, etc.) is critical to success. If you don’t have a clear goal and a plan for getting there, how do you know when it’s time adjust your course and what adjustments to make? Set realistic expectations, but get information about WHERE you are relative to those expectations often.

- There’s a tendency to have high expectations at the beginning, but constant change can be wearying – you’ll have to remind yourself what your initial vision was from time to time. In business, a long-term vision can pull you through the toughest times. Be sure that you have the long-term in mind, and are able to visualize what you’re doing all the hard work for when things go pear-shaped.

- Ultimately, it’s up to you to make the most of it – you get out what you put in! In business, hard work and dedication are expected. But remembering why you are working hard can help – so be sure that your vision will inspire you on those days when all you really want to do is sleep in!

- My ideal vacation is nothing like your ideal vacation…The only way to really enjoy a vacation is to make sure that it fits the person traveling, regardless of where other people are going (or have been).Every business is unique, just like every person is unique. So what works for your business may or may not work for mine. Likewise, just because it didn’t work for someone else doesn’t mean it won’t work for me. Look at other people’s experiences as research, and then trust your gut when it comes to yours.

- Lastly, if you stay open to new experiences, you meet some of the nicest people along the way, and discover that the detours could be the best part of the trip.In business, things will never go exactly the way you planned – so realize that unexpected doesn’t mean unwelcome. The major setback on a project could be the catalyst for a whole new line of products. Stay focused on your vision, and you’ll be better able to enjoy the twists and turns along the way.

So the next time that you’re facing a huge challenge, try reframing your frustration by comparing your situation to an exotic vacation. Imagine yourself stuck in a taxi on the way to a beautiful white-sand beach, or ordering what you thought was the vegetarian plate, and being served a fish with the head still on.

Yes, those are frustrating moments, but they’re also experiences that teach you not to take yourself so seriously, that help you refine your sense of when to stick with the plan and when to wing it. These experiences help you understand that true joy can be found in the small things, and that the most rewarding part of building a business (just like an exotic vacation) isn’t getting there, it’s enjoying the trip.

Tags: It's All In Your HeadSignposts And DirectionsWalk The Walk

5 Jedi Mindtraps to Avoid When You Think About Financing

By Stephanie Sims February 26, 2014 Blog, Where's the money?

When it comes to getting a loan or taking on a partner, many small business owners feel a lot like young Luke Skywalker after he crashed his fighter – dazed and confused. Their preconceived ideas about the people and the process, most of which are just wrong, keep them from seeing how everything could work together for their benefit. So before you start talking to banks and investors about investing in your company, be sure that you don’t fall prey to these common mindtraps.

Trap # 1: Bankers & investors are smarter than me

Although bankers and investors have a different kind of knowledge than you, they aren’t any smarter (or better) than you! Because asking for help is always difficult, particularly when it involves your business, I think that we tell ourselves this story to explain our feelings of inferiority.

What to do: Instead of focusing on what you don’t know, take the time to write down the good and bad of your business. The good is a list of your assets (what you do well) and the bad is a list of the risks (where you might need improvement, or where you aren’t sure what you will do). Detailing your strengths and your weaknesses will help clarify what you have to offer and where you need help.

Then, as you meet with them, think of your banker / investor as any other vendor. They are experts in their business, but they are there to help your business succeed. No one knows your business as well as you do, and any loan or investment will be made on the basis of what you have built. Once you are clear about what you have to offer (and where you need help), it is much easier to explain that value to someone else.

Trap # 2: Bankers & investors want to take advantage of me

As mentioned above, bankers and investors are in the business of investing. They aren’t sharks – even if they play them on TV.

The business of investing means that they need to earn a certain amount on every dollar that they invest, and they need to ensure that they make investments that will actually be paid back. Bankers and investors have a responsibility to their clients (who give them the money that they invest), namely to earn them the highest return for the risk that those clients are willing to accept.

While bankers and investors are experts in the risk/reward game, they aren’t scrooges out to steal or swindle you – they’re just doing their jobs and using their experience to do the best jobs they can for their clients.

What to do: Learn everything you can about how bankers and investors make their decisions (this is a good place to start). Use the list you made of strengths and weaknesses to understand what your business offers in terms of risks (weaknesses) and rewards (strengths), and don’t be afraid to make changes to reduce the risks and improve the rewards.

Trap #3: I need to have solved all the problems in my business before I talk to a bank or an investor

Nobody’s perfect, and if you have already solved all the problems in your business, you won’t need a loan or investment anyway. What banks and investors are looking for is not a perfect business, but a business that has a good potential and an owner who understands the risks of his business and how to manage them.

While you can’t go into a discussion with an investor without a good plan, it’s perfectly acceptable to leave some of the details to be ironed out later. How to know the right level of detail? If it will change one of your strengths by more than 10%, or increase a risk by that amount, it needs to be hammered out.

What to do: Evaluate your list of weaknesses using “disaster” scenario. For each weakness, ask yourself “if I can’t find a solution to this particular issue, what is the worst thing that can happen?” If the answer will kill or significantly diminish your business, or if worrying about it keeps you up at night, you need to find a solution before talking to an investor. Otherwise, it’s a detail.

Trap #4: I need to pretend to be someone I’m not in order to get banks & investors interested

There’s a perception that perfect projections, pitches and owners are what win bankers and investors over. Not at all – what wins investors over is solid projections and pitches made by passionate and credible owners. Bankers and investors see hundreds if not thousands of deals over their careers, and they aren’t sold by a pitch alone.

When making an investment in your company, they are ultimately investing in your vision and your ability to accomplish that vision. You need to help them see that vision clearly, and show them what it will take to get there, in terms of money, time and commitment. If you can show a compelling vision and a reasonable probability of reaching it, you’ll be heads above all those other “perfect” pitches.

What to do: Develop a relationship with your potential investor before asking for funds. If possible, present them with an overview of your strengths and weaknesses, and ask for their advice about improving your operations and/or reducing risks.

When you’re ready to ask for funds, understand the value in your business, and get comfortable with explaining that value – in your words, your way. A banker or investor doesn’t want some slick presentation, they want to see how well you understand your business and how you can make it work. They need to see you as credible yet passionate, enthusiastic but realistic about the challenges you’ll face. Perfect only works in the movies.

Trap #5: I’ll do a lot of work for “nothing” if I create financial projections and then don’t find an investor

Like the famous “business plan”, many owners view the creation of financial projections (budgets) as an exercise that’s only useful when asking for financing. Nothing could be further from the truth!

Just as your vision will guide your business over the long-term, your financial projections will ensure that you are taking regular steps to achieve that vision. In order to have $1,000,000 in sales in 5 years, you need to sell your first product! It’s unreasonable to expect that sales go from $0 to $1,000,000, so you need a plan to help you track your progress. That means translating the long term goal into several shorter-term targets. Perhaps the first year’s target is only $120,000 – so you know that you need to sell $10,000 per month. That’s an easy figure to check, and to keep in your head throughout the year to measure your progress.

Likewise with expenses, if you know that you have only planned to spend $240,000 in the first year of operations, any expense over $20,000 per month should sound alarm bells in your head.

Having short-term targets can help you keep your business on track, and as the business grows, can also serve as targets for employees (sales managers, etc.). By instituting a budget early on, you not only set yourself up for success, but you build credibility with future investors, since they will be able to easily measure your projections against your performance.

What to do: Build a financial projection (budget) that helps you manage your business – it doesn’t have to be fancy, but you must understand all the assumptions. You should include an income (or profit and loss) statement and a cash flow (or sources and uses of cash) statement. The income statement will help you understand when your business becomes profitable (sales are greater than expenses), which is usually a point at which you need less external financing. The cash flow statement will help you understand when you need financing, and what it will be used for (either operations, before you become profitable, or for equipment/durable good purchases after profitability).

And once you’ve built the budget, be sure that you are comparing your performance to that budget regularly: at least monthly for sales and operating expenses, and at least quarterly for any equipment purchases. If you see any major variances (10% or more), DIG IN and understand where they are coming from – problems don’t magically fix themselves, so you need to identify them and try solutions until you find the right one for the situation at hand.

Each of these mindtraps are founded on a faulty perception / point of view. Because a perception exists within your mind, you can avoid these traps by educating yourself, and taking specific action to combat that perception. You have the ability to make these changes by taking concrete steps to understand the value of what you’ve created and to build that value over time. And it will not only improve your chances of getting financing, it will also improve your outlook!

Tags: It's All In Your Head - Number Whispering Risk/Reward - Talk The Talk

10/08/15 Stop Spending, Start Investing

By Stephanie Sims October 8, 2015

One of the biggest improvements you can make TODAY in your business is in the way that you make decisions about your money.

Most owners think in terms of how much they “make” and how much they “spend”.

To build a business that attracts investment, though, you need to show that you are a good investment.

Being a good investment means using all of the resources you’ve got (energy, time and money) wisely – and then demonstrating how the resources you have invested are helping your business grow.

It’s all YOU

Your business grows as a result of the decisions you make, so you need to develop a habit of making decisions that continually move you closer to your goals. You might be surprised to know that one of the biggest blocks to making those kinds of decisions is…YOU.

Yes, identifying with your business, and seeing the results of your business decisions as a measure of your worth keeps plenty of us from doing what needs to be done.

So it’s crucial to create a frame of reference that allows you to make decisions using your stated goals and to view the results of your decisions as feedback, NOT as a judgement of your ability as a biz owner.

But there is a way to make it simple

One great way to do this is to practice seeing your business as others will see it – as an investment. If you’re like most owners, the mention of “investment” can freak you out. But that’s where using your Finance-Ability® and growing your PII™ can make your life much easier.

How?

By asking yourself questions based on the PII™ framework when you’re in decision-making mode! And no, not questions like “Can I afford this?” or “Am I doing the right thing?”

Having a specific set of questions to ask yourself takes the “personal” out of the equation, and makes it easier to develop the habit.

So how does this work?

The next time you’ve got to decide to put money or time towards anything, try this method for making your decision:

Step 1 - Gather Data

Step 2 - Ask These Questions

Step 3 - Yes or No?

Once you’ve decided to make an investment, you’ll want to find some small steps, or mini-results, that will show you that you’re on the right track along the way, and decide how many of those need to happen in order to justify this investment.

Those small steps will also be your measurements once the investment has been made, and to ensure you “get your money’s worth”, you’ll want to track them closely all along the way.

So what’s the bottom line?

Being a business owner means that you’ve got plenty of freedom, but also a responsibility:

To use all of your resources (energy, time and money) wisely

Having a system for making decisions about where to invest those resources will not only help you make better decisions, it will set you up for talking about those decisions with the Suits.

The Suits want to invest in owners who know how to make the right decisions. This system is a good place to start making (and documenting) your great decisions.

Ready to treat your business like an investment? Share this post with the hashtag #InvestingInMyBiz and tell me what you’re doing!

Tweet Share